Read Our Blog

IRS Audits Explained

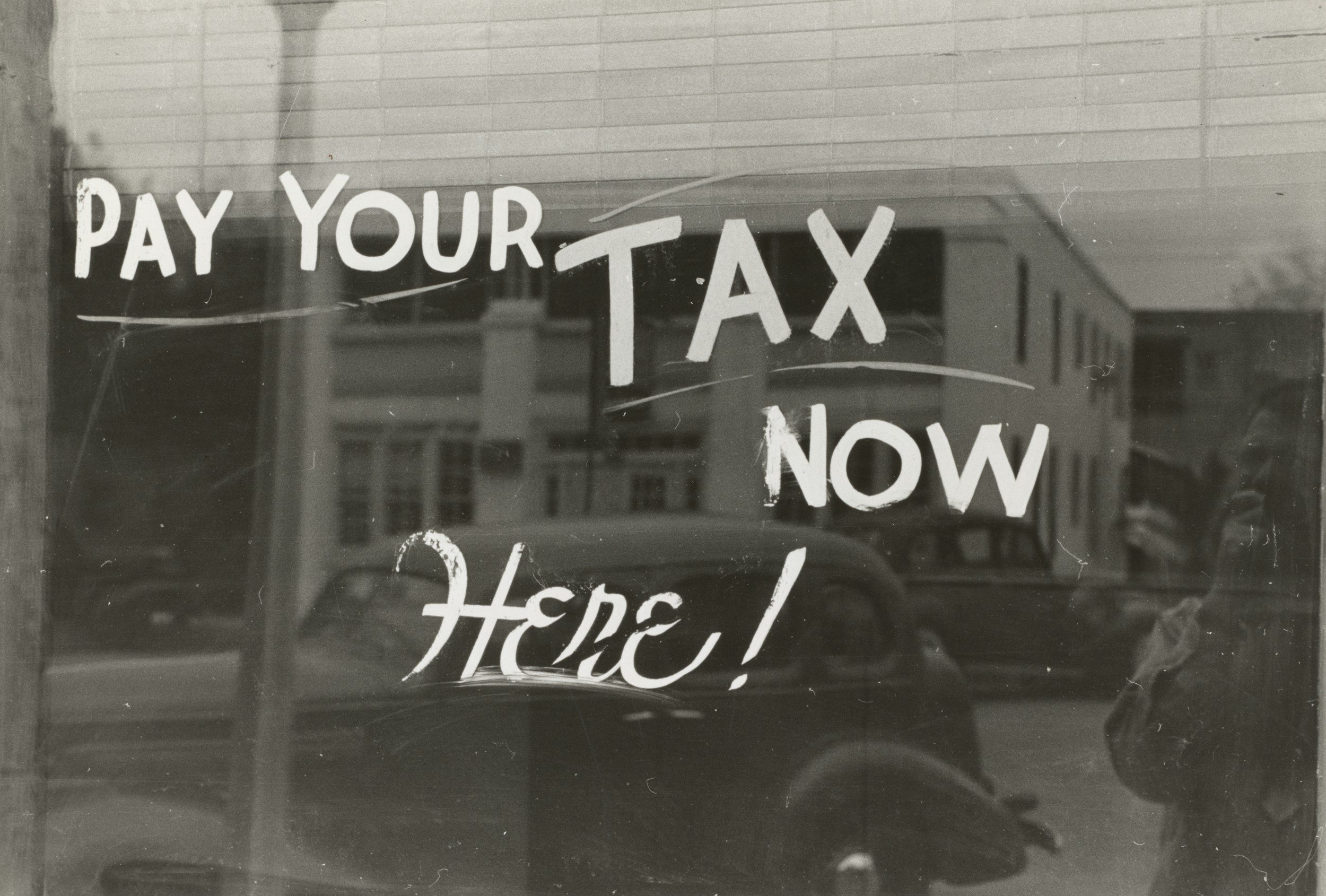

Anyone who files taxes likely bristles at the utterance of the word “audit.” While cannabis companies tend to attract more scrutiny than other businesses, it doesn’t have to be a horror show.

Understanding the Importance of Clean Books

Business owners understand the need for meticulous financial management. Maintaining your books is an ongoing process that has many benefits. In addition to having a better grip on your cash flow, it simplifies compliance, audits, and tax filing.

But what does it mean to have “clean” books?

Tax Tips for Running a Business

Launching a new business is an exciting move. It can be massively rewarding, too, helping you bring your dreams to fruition and affording you incredible financial freedom—if you do it right. Fortunately, with some knowledge and planning, it’s possible to mitigate all that stress so you can get back to doing what you love to do… and we know that’s not taxes!

Unlocking Potential with 280E Assets for Cannabis Business Exits

While cannabis companies may be restricted in many ways, leveraging certain assets can help to recover costs and potentially reduce tax liability.

ESOP for Cannabis: A Hot Exit Strategy with Misleading Tax Claims

A few of my clients have mentioned receiving emails about Employee Stock Ownership Plans (ESOPs) for cannabis companies, touting it as a strategy to pay no federal or state taxes. This statement is hugely misleading as you can’t avoid tax—it can only be deferred, meaning you’ll have to pay eventually. That being said, ESOP is an excellent exit strategy… with a few caveats.

Cannabis Rescheduling: What Happens Next with 280E?

Will they, or won’t they? We’re all waiting on pins and needles to find out whether the DEA will agree to reschedule cannabis to Schedule III from where it currently resides at Schedule I.

Understanding the IRS Disaster Tax Relief Program

In light of the devastating fires and other disasters we’re experiencing in California, many businesses may be poorly positioned to carry on business as usual. Fortunately, there is a grain of good news to share that may ease the way forward.

Navigating Cannabis: Essential Tax And Accounting Guidelines

Navigating the complex world of cannabis accounting can be a daunting task for many business owners in the industry. With the ever-changing regulations and financial nuances, understanding the role of a Cannabis Certified Public Accountant (CPA) is crucial.

IRS Audit Triggers

The cannabis industry is booming, but with growth comes increased scrutiny from the Internal Revenue Service (IRS). Understanding IRS audit triggers is crucial for cannabis businesses to remain compliant and avoid hefty penalties.

What Cannabis Companies Need to Know About 280E

In the rapidly evolving world of cannabis, businesses face unique challenges, especially when it comes to taxation. One of the most significant hurdles is navigating Section 280E of the Internal Revenue Code.